The remodeling contracting business is an essential part of both the residential construction and commercial construction industry. Remodel construction contributes to maintaining the existing housing supply and commercial space needs in business.

Without the remodeling contracting business, the pricing of the existing housing supply would become unstable and erratically fluctuate due to all housing types deteriorating at an accelerated rate.

The remodeling industry plays a significant role in not only stabilizing costs but can also have an economic impact on the supply and demand side. With today’s remodeling contracting practices, owners are able to make their houses and commercial buildings look like they are new.

So, both the new house construction industry and the remodeling contracting industry have a substantial impact on each other’s economic behavior. We will explore this relationship and look at the Houston and national remodeling construction industry performance and economic trends.

The last half decade has seen a surge in demand for the need to renovate houses and for remodeling contracting services in Houston. This has also been a similar trend nationally.

This increase in demand for these services is principally the result of a tight inventory level of available single-family homes throughout Houston and across the United States in general. This reflects both resale and new construction housing starts.

Remodeling contracting construction is estimated to surpass $4.75 trillion annually by 2026 according to MarketWatch.com. This consists of both homeowner & rental improvements as well as building maintenance.

It is estimated that another $100 billion in annual expenditures is credited to commercial remodeling contracting construction.

The Joint Center for Housing Studies from Harvard University recorded an 8% increase in remodeling expenditures in 2020 over 2019.

This all comes down to making the remodeling contracting industry market segment a monster of proportion. The growth trend in the industry and the greatest amount of year over year growth are attributed to the top major metropolitan cities.

This is primarily due to rising single family housing prices in these cities, limited available housing inventory, growing urban populations, and double digit inflation due to the economic practices implemented during the pandemic.

The economic pressures of higher new home prices cause new house buyers to pause when it comes to them buying a new construction home.

At face value when these homeowners begin to compare the investment required to renovate an existing property to buying a newly built house, most homeowners choose the remodeling contracting option.

There are certainly other factors that come into play during this decision-making process, but the total affordability of the required investment to get a premium house remodeling contract completed is undeniable.

The same can be said about commercial remodeling contracting when comparing the investment required to buying an entire office building instead of a complete renovation of the interior or planning a building addition.

Although the process of construction is similar in both commercial and residential construction, the demand for residential remodeling contracting dwarfs commercial due to the sheer numbers of the market size.

The recent and expected continuing rise in interest rates in 2022 and beyond will also put pressure on new construction housing starts and new commercial building construction.

As demand continues for housing and updated commercial business space, property owners are expected to turn to remodeling contracting for the foreseeable future.

Although the rising cost of labor and materials is expected to slow the red hot home improvement market which according to Harvard University Joint Study Group, it is expected to peak in Mid 2022 before gradually tapering to a more stabilized level in 2023 – 2026.

Discover the Houston and National Remodeling Contracting Business Trends

Factors Driving Remodeling Contracting Markets

There are a number of factors that drive the remodeling contracting and home improvement markets. There are many economic factors that have an impact on both short term and long-term industry trends.

Interest rates and employment rates will always have a shorter-term direct impact on the demand for these services. Although interest rates continue to escalate as the Fed battles inflation, national unemployment continues to be at historic low levels.

There are other factors that have a longer-term impact on the remodeling and renovation market that we will examine;

- Aging Single Family Housing Stock

- Home Improvement Expenditures

- Rising Land and House Prices

- Renovate & Remodeling Construction Future

Aging Single Family Housing Stock

The aging housing stock also has a significant impact on the remodeling industry. The average age of the national housing stock is 37 years. This is up sharply from 31 years in 2005.

The new home construction market has not been able to keep up with the aging housing stock. This has also contributed largely to the surge in the remodeling market. Interestingly enough, 70% of all the new houses built after 2010 are owned by Gen-X & Millennials.

While on the reverse side, 56% of houses built before 1970 are homeowners of age 55+, according to the NAHB.

The new house construction market is a $118 billion market in 2022 according to IBS World. This currently represents 1.6 million housing starts as of January 2019.

The new home building industry typically maintains about a 5-month supply of available houses to purchase.

The national market share of existing house inventory levels is currently at a 3.5-month supply of houses on the market. Lower supply levels also create economic pressure of holding and driving prices due to shrinking housing inventories.

Although the home building industry has sustained consistent growth for more than a decade, experts do not see this trend continuing.

With rising interest rates, inflationary price pressures expect to compound the complications with the housing inventory reducing the record pace of the past 10 years.

Home Improvement Expenditures by Project Sector

The JCHS breaks up the remodeling projects into 3 categories, discretionary, replacement, and essential.

- Discretionary expenditures are just what they sound like. The owners are electing to improve their homes because they want to.

- Replacement expenditures are generally associated with products that have reached their functional lifecycle and need replacement.

- The essential expenditures are reflected by incidents like disasters or accidents.

The largest expenditure sector is the replacement expenditure market. These would be interior, and exterior products and equipment. This represents products like doors & windows, roofing, siding, and equipment like air conditioning and hot water heaters. This sector represents nearly 50% of the total home improvement expenditures market.

The second largest home improvement sector would be remodeling and renovations. This sector represents kitchen & bath remodels, home additions, and garage & porch attachments. This sector represents about 35% of the total home improvement expenditures market.

The smallest sector of home improvements is disaster and accident home improvements. These are generally associated with insurance losses that result from house insurance claims.

Rising Land and House Prices

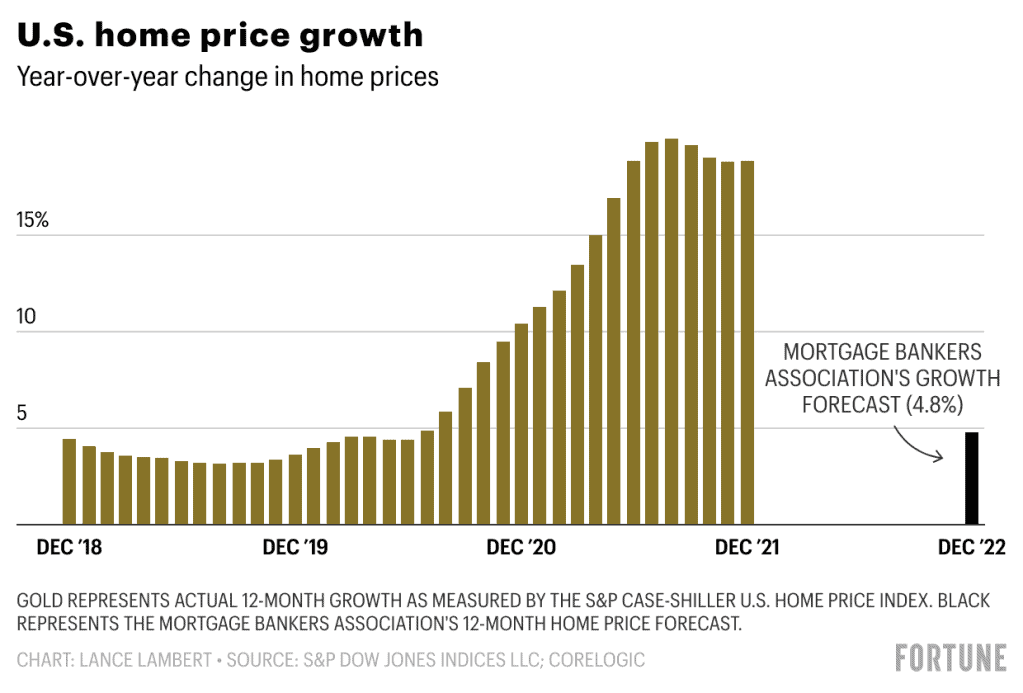

Land and house prices traditionally increase by 2%-4% annually. According to Fortune.com, in 2019 – 2021 house prices have risen more than 10% quarter over quarter.

House prices are expected to slow to 4.8% in 2022 closer to historical levels nationally. In Houston, house prices have risen an average of 20.9% from 2020 to 2021 with an average price of $261,791 according to Zillow.com.

Renovate & Remodeling Construction Future

Renovate and remodeling construction will continue to grow and become a more important part of the housing option determination process.

With home prices steadily rising coupled with the actual number of single-family homeowners shrinking, the home improvement industry will continue to grow and contribute to the future of US housing.

There have been considerable advances in the remodeling industry in home products and building materials over the last several decades. Products like Hardi-plank & smart home technology have made older houses more sustainable and have a longer service life.

The replacement product market trends have been ecofriendly. Home products that conserve energy and have a greater service life before the need to replace. Computerized interior products and operating software continue to be a larger part of our homeownership experience.

The creation of new home building materials like manmade stone & flooring materials has also made houses more sustainable. The trend toward new home product materials that conserve our natural resources has also gained momentum.

Another major trend in home building materials is a constantly growing number of product options available to consumers. More options provide the consumer with a greater selection of options to choose from.

Garage doors are a good example of multiple style product options available. Once a very generic product has blossomed into a larger number of choices for homeowners to select architectural garage doors.

The future of home remodeling and renovation will play a larger role in homeowners building product purchasing and improvement strategies for years to come. The trends suggest that the way people purchase home renovation products and services is also changing.

With the 3D designing capabilities, owners can clearly see what a finished product will feel like before it is built. These images can also introduce color and texture to assist with decor decision making. The future of the remodeling and home renovation industry will continue to be more customer friendly.

Conclusion

Renovation and remodeling contracting services industry in Houston will continue its annual growth in revenues for the foreseeable future supported by a tight new home construction inventory, rising interest rates and high employment levels. Renovations and remodeling will continue to grow in demand as housing options continue to challenge the Houston market.