A perfect storm is arising in the commercial property office space rental industry. Rental office space owners are already under duress as commercial property vacancy rates continue to increase, causing rental revenue to decrease.

This issue only gets worse as the Fed continues to increase interest rates leaving financial lenders to hold the bag on nonperforming commercial mortgages that will not be able to refinance with their current revenue from the shrinking rent rolls.

Commercial property has widely been a preferred investment hedge against inflation and used for creating passive income as a revenue producing asset for many decades.

Commercial Property Office Building Market

This asset class’s long-standing popularity has been steadily declining in performance the past 5 years due in no small part to the pandemic and changing cultural work habits throughout the country.

This has been clear for some time demonstrated by the trend of long-term tenants reducing their gross leasable office space commitment needs.

The demand for office space has been declining primarily due to the technological ability of employees to serve the business remotely. This trend was only intensified when the COVID pandemic lockdown required most people to work from home.

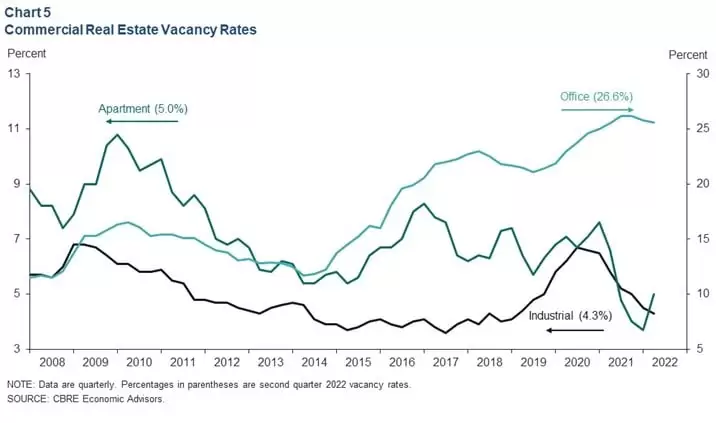

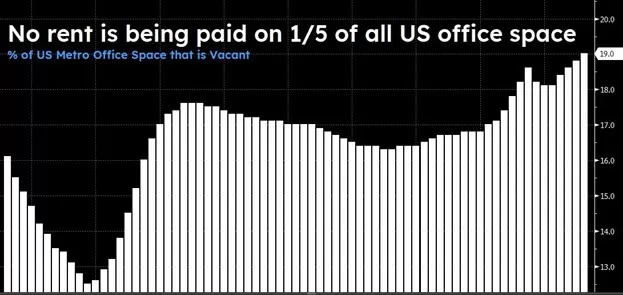

The demand for commercial property and specially office building space nationally is in decline and reaching record vacancy rates the past 5 years and is expected to worsen over the next 5 years as indicated by the CBRE Economic Advisers graph below.

These vacancy rates have caused a far greater potential issue than just pressure on commercial property holders cash flow and financial resources. The loss of rental revenue has made refinancing these assets at their current mortgage balances near to impossible because of the declining revenue.

With typical commercial property mortgages being issued in 5 years to 20-year terms, this leaves a large number of commercial property holders in a difficult financial situation facing default as their mortgage debt becomes mature and little resources available refinance.

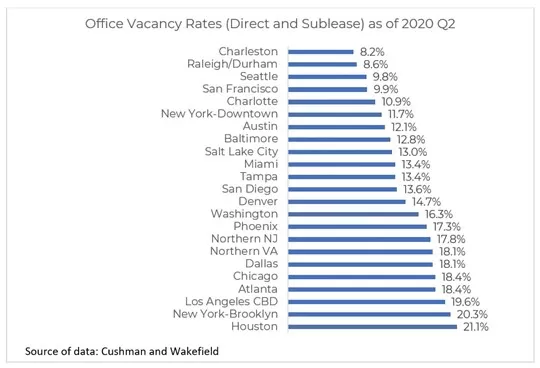

Although this problem is greater in the major cities like Houston, New York, Chicago and LA, this has become a national problem that is likely to impact the US economy.

As you can see from the graph provided by Cushman & Wakefield, that vacancy rate levels have reached near or in excess of 20%, double what most commercial property owners consider normal levels.

Houston has one of the highest vacancy rates in the nation.

Commercial Property Debt Crisis on Horizon

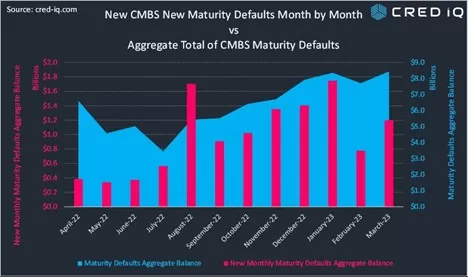

More than $1.5 trillion dollar in debt is expected to mature in the next 3 -5 years leaving these unfortunate owners with very few options other than default.

If the property owner does not have the liquid financial resources for making up the short falls in the property’s rental revenue, they are not likely to refinance their property mortgage when they mature.

Even if they have the resources to refinance, the debt service will substantially reduce the income (cap rates) on this asset class making them far less attractive than other investment opportunities.

The consequences of this financial storm will only further reduce the depressed office building prices and values for these prized assets and place pressure on rental cost of other performing commercial office properties.

Options for Poorly Performing Office Building Property

If a property owner finds themselves in this predicament and do not have the resources to restructure the property loan, then there still are some options that might be available to them other than default.

Depending on the age & condition of the building and the location of the property, the land may be in fact more valuable than the building. In which case, razing the building and selling the land or razing the building and constructing ground up may be your best option.

This option clearly requires a good deal of research and the preparation of a financial feasibility analysis, but absolutely becomes a better option than default.

Building ground up construction would require far more effort and a property that would provide an effective revenue generating income that would be profitable and create some interest for the financial lending industry.

If these options are not feasible or you’re not interested in these alternatives, another option that would preserve the greater value of the building and possibly cure your cash flow problems in a relatively short time frame is to convert your office space into residential apartments or condos.

Opportunities for Commercial to Residential Conversions

Many owners are turning to converting commercial property into residential property as a solution to their cash flow problems with rental office space.

This may not apply to all properties and of course has some substantial conversion cost investments required.

The best buildings for conversions depend on a number of existing conditions such as the height of the building, the structural design and capacity and the existing fire alarm and sprinklers if the building has fixed glass curtain wall. More about these factors to come.

The reason that converting rental office space into residential rental space is an attractive idea is because there is a national housing shortage. With that said, the greater the shortage of housing the greater the opportunity is in your area.

This is a result of the residential housing industry suffering from a massive inventory shortage the past decade and the pandemic only made worse.

A few words about the national housing shortage, it began in 2008 with the national financial and mortgage crisis, that threw the US into 4 years of economic recession or deprecation, depending on your perspective. From this writer’s point of view, it was a depression although Houston had a softer time than many regions of the country.

As reported by Business News from CNN, the Federal Reserve Board Chairman was quoted as stating that 2008 was the worst financial crisis in global history.

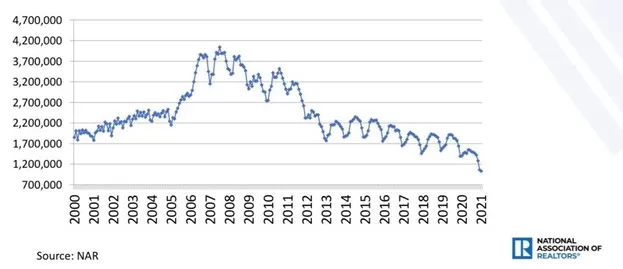

During the years of 2007 – 2010, the housing inventory for the US average was more than 3 million single family units according the National Realtors Association. This was more than 1 million housing units that the market had averaged to be considered healthy.

During this period, home builders stopped building, which caused skilled labor to find alternative sources of income. Most of them left the industry and did not return.

When the housing industry began to recover in 2011 – 2012, they found that the demand for housing was at an all-time high, but they did not have the labor resources to meet the demand.

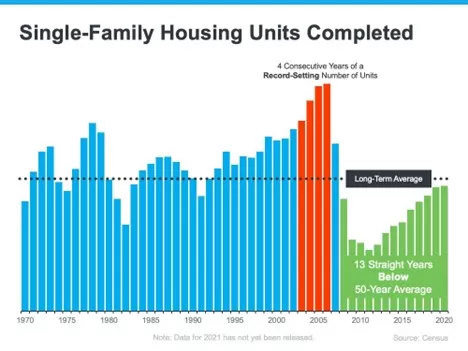

This trend extended through 2020 up to the pandemic, where the national shutdown once again had a huge impact on the production of houses, as seen in the following graph sources through Consus depicting 13+ years of subaverage single family starts.

Commercial Properties Qualifications for Conversions

From a non-construction perspective, there are restraints for converting office space to residential rental spaces.

These restraints are associated with zoning or in the case of Houston Texas, the deed restrictions that are enforced by a HOA. The deed restrictions provide the guidelines for architectural approval for structures, acceptable use of dwellings, there boundary setbacks and the conditions of general-purpose use.

In other words, you will normally need their permission before you will be issued a building permit application.

In addition, most office building properties do not have the amenity packages that residential multi-family properties have for their tenants, nor the convenances such as nearby grocery stores and activity centers like tennis courts or swimming pools.

The amenities will have an impact on making your rental property attractive to tenants.

Tenant parking should also be considered, but in Houston the requirements for an office building are normally twice those of an apartment. If you are considering converting a hotel to apartments, the need for additional parking spaces would be required.

Cost of Converting Commercial to Residential

Repurposing commercial property to residentials will have its construction challenges. Although it will be far more cost effective than building new ground up construction.

There are many factors to take into consideration in the planning and concept budget preparation. We have prepared a list of the key “as built” condition assessments that should be considered;

- Structural type of building and general condition – Understanding the general structural condition is key to deciding if the building should be razed or is sound enough for further investment.The type of structure has everything to do with making required penetrations for plumbing waste lines for bathrooms & kitchens that will be required.

- HVAC system – Most office buildings have a common central system for offices and common areas, without the personal control of separate thermostats. It is important to develop a plan that will either modify the existing cooling system or/and provide the personal control you will need for individual apartment unit systems.

- Existing Life Safety System – It is typical for office buildings to not have operational windows, but instead fixed glass curtain walls. The office building should have a life safety system including approved fire sprinkler and fire alarm system, a minimum of 2 stairways as egress and the proper sized entry doors that lead to the stairways.

- Plumbing system – Careful evaluation should be considered for both supply lines and waste line sizes and capacity for the additional number of units that will be brought on line with the apartments. Increasing the number of bathrooms and adding kitchens may very well increase the requirements of additional capacity which means developing a creative solution to accessing additional sewer taps and water meters.

Be mindful about boilers or the need for hot water heating for each of the units.

There will also be a plan to provide a laundry room for each of the units or a common area designated for this purpose.

Some additional optional requirements for converting rental office space to residential rentals is the need for separate electrical metering. Most office buildings tenants are charged on a NNN basis for all common utilities. In the case of electrical a fee structure can be developed for common electrical cost shared by all tenants, but in some cases (separate HVAC units) this may not be an option.

Metering each unit will require that an electric subpanel be added to each unit and a separate meter be introduced to the building. This usually means that the electrical wiring will need to be rerouted from the electrical switch room.

In addition, by adding a complete operating kitchen, washer & dryer and separate HVAC system to each unit will substantially increase the demand for additional electric for the entire building. This means additional switch gear equipment and the possible need for a larger reserve required from your electrical provider.

You can expect the cost of such a conversion to be in the range of $75 to $200 depending on the finished and the additional building improvements we have discussed.

So, as you can see, that the commercial property conversion can be an affordable solution depending on the existing building.